Financial Fitness

Making Cents Financial Fitness

Welcome to Making Cents, our financial education hub! Here, we're all about making money matters less daunting and more accessible for everyone. Whether you're a seasoned investor, a newbie to the finance game or just someone curious about managing money better, you're in the right spot. Making Cents will give you the tools, tips and know-how to feel confident about your finances, whatever your goals may be.

This financial fitness program is designed to provide you with the most relevant and informative financial information and solutions to real life, everyday, financial topics that you can learn from and apply to your daily financial strategies.

Every other month, we will introduce a new topic to keep you fit. Each topic will include a short video that explains the lesson in depth, a published article and additional resources to help you apply what you've learned to your financial journey.

From budgeting basics to investment insights, we've got your back. So, kick back, relax and let's dive into the world of finance together!

Understanding the Credit Union Difference

June 2025

Did you know that there is a BIG difference between traditional banks and credit unions and that credit unions are founded on a "People Helping People" principle? Or even that Credit Unions are considered not-for-profit so that their earning can be used to provide products and services at a lower interest rate to it's member AND be used to support and enhance the communities in which they serve? There are so many benefits to members of credit unions that just aren't offered by banks. Whether your are new to credit unions or a long-time member, there is so much more to your financial that you should know. Sit back and let us tell you all about it with this month's topic: The Credit Union Difference!

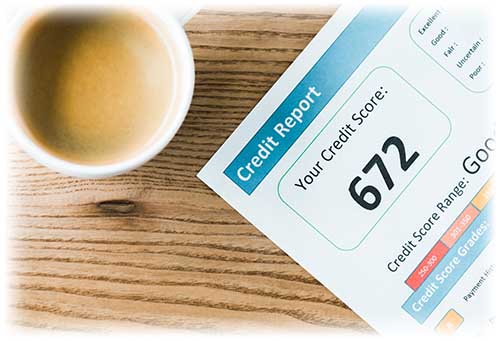

Understanding Your Credit Score

August 2025

Did you know that your credit score can impact everything from getting approved for a loan to how much you pay in interest or even if you can rent an apartment? Did you know your credit score is based on things like your payment history, how much you owe and how long you’ve had credit? There’s a lot more to your credit score than just a number and understanding it can make a BIG difference in your financial future. Whether you’re just getting started or looking to boost your score, there’s so much more to know. Sit back and let us walk you through it with this month’s topic: Credit Score!

Your Spending Plan

October 2025

Creating a spending plan isn’t about restricting your money, it’s about taking control of it. A good spending plan helps you understand where your money is going, prioritize what matters most, and prepare for the unexpected. Whether you’re saving for something big, paying down debt, or just trying to make ends meet, having a plan can make all the difference. Let us walk you through it with this month’s topic: Your Spending Plan!

Predatory Lending

December 2025

Did you know that some loans and financial products are designed to trap borrowers in cycles of high fees and growing debt? When money is tight, offers that promise “fast cash” or “easy approval” can seem helpful, but they often come with hidden risks. Predatory lending can impact your finances, your credit and your peace of mind. Knowing what to watch for can make a BIG difference in protecting your financial future. Whether you’re borrowing now or just want to be prepared, there’s so much more to know. Sit back and let us walk you through it with this month’s topic: Predatory Lending!

Generational Wealth

February 2026

Did you know that building wealth isn’t just about what you earn today, but what you can pass on tomorrow? Generational wealth is about creating long-term financial security and opportunities for your family, helping future generations focus on growth instead of just getting by. From homeownership and investments to education and estate planning, the choices you make now can have a lasting impact. Whether you’re just starting out or looking to strengthen what you’ve already built, there’s so much more to know. Sit back and let us walk you through it with this month’s topic: Building Generational Wealth!

Financial Coaching

Our goal is to help you, our member, navigate your financial challenges by offering personalized support and guidance.

Our goal is to help you, our member, navigate your financial challenges by offering personalized support and guidance.

The Making Cents Financial Coaching Program is about building a relationship with you, where we listen deeply and seek to understand your financial behaviors, needs and goals.

We understand that every person's financial journey is unique, and we're here to meet you where you are, without judgement. By focusing on you, we will help you craft a personalized plan to flex your financial muscles and build lasting financial strength. We invite you to schedule an appointment with an Ascentra Financial Coach TODAY!

-

Calculators

Having trouble crunching the numbers? We make it easy for you with our online calculators. -

Worksheets

Whether you're budgeting for college or balancing your checkbook, we have a worksheet that will help. -

GreenPath Financial Wellness

Stuck in a financial rut? GreenPath offers free financial counseling to all Ascentra members to get you back into tip-top shape.

Financial Fitness Resources

-

Checking Accounts

Whether you’re looking for a rewards program, no service charges, or overdraft protection, we have a checking account that fits your needs.

-

Ascentra Anywhere

Ascentra Anywhere allows you to do all your banking with the click of a button or tap of your finger. This includes our Mobile App, Pay Bills, Financial Tools, Digital Wallets, and Mobile Payments. It’s banking made easy, anywhere!

-

Credit Card

No hidden fees. No surprises. No hassle. With the Ascentra Credit Card, what you see is what you get, which includes no annual fee, no balance transfer fee, AND low rates. We call that a win!

-

Fixed Rate Mortgage

10 & Done (10 Year Fixed)5.25View Mortgage Loans% -

Vehicle Loans

New & Used Auto as Low as4.99View Vehicle Loans% APR -

Savings

Membership Share Savings Starting at0.05View Savings Accounts% APY -

Credit Cards

No Balance Transfer Fee. 6-Mo. Intro Balance Transfer2.99View Credit Cards% APR