Predatory Lending

Spot Predatory Lending and Use Smart Alternatives

How to recognize predatory financial services, understand how they operate and choose better solutions

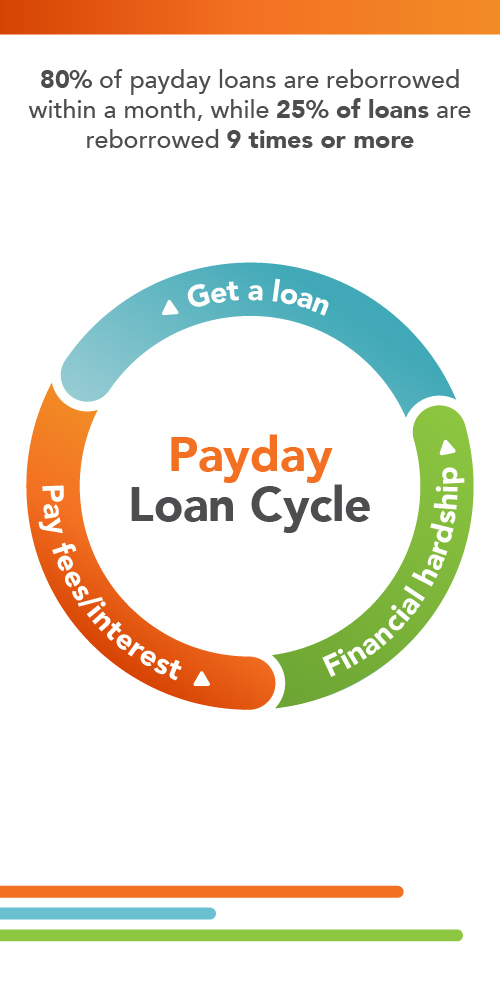

Payday loans are a predatory pitfall

Payday loans, for example, are promoted as quick fixes, no credit checks, instant cash, but the reality is far harsher. With annual percentage rates (APRs) ranging from 300 to 800%, these short-term loans can quickly spiral out of control. According to the Consumer Financial Protection Bureau, over 80% of payday loans are reborrowed within a month, and one in four borrowers reborrow 9 or more times. Borrowers often end up paying more in fees than they initially borrowed.

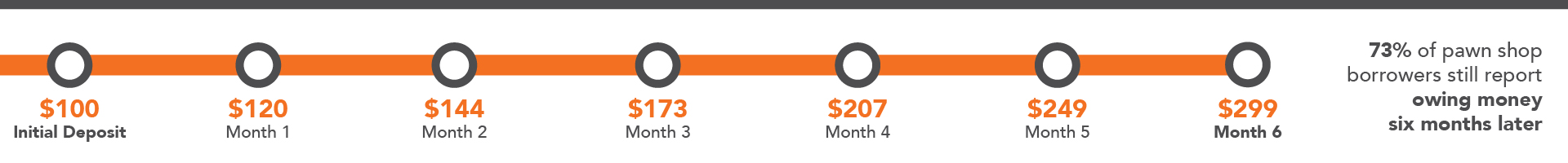

Pawn shops are another predatory risk

Pawn shops offer quick loans against personal items like jewelry or electronics, but with high interest and short repayment windows, usually 30 to 90 days. If you cannot repay on time, they will either extend the loan for extra fees or sell your valuables. In a 2019 survey, 73% of pawn borrowers still owed money six months later.

Car title loans can leave you stranded

Car title loans are similar because they use your car as collateral. Title loan lenders rarely verify income or credit; they do not need to, because if you default, they take your car. Many own dealerships, meaning they profit from both your payments and the resale of your vehicle.

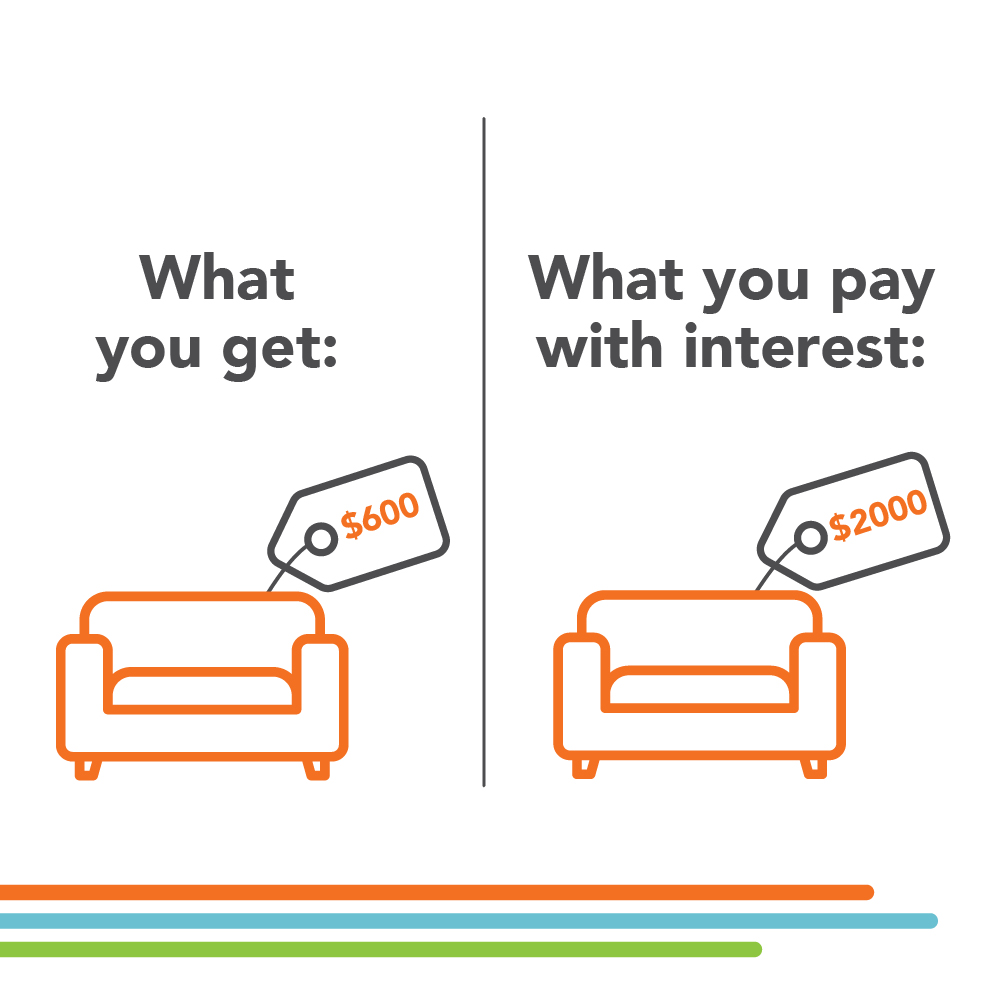

Rent-to-own stores may seem harmless but can be just as predatory

Paying $30 a week for a couch might sound affordable, until you realize that the same $600 couch could cost you $2,000 by the end of the contract. With effective APRs ranging from 43 to 468%, rent-to-own agreements charge far more than a traditional purchase or even a credit card.

Even housing can fall into the predatory trap

“Rent-to-own” or contract mortgages often target people who cannot qualify for traditional loans. These deals typically include high interest rates, balloon payments and strict terms. Miss a payment or break a rule, and you lose both the home and every dollar you have invested.

![]()

If you need emergency cash, a personal loan from a credit union is a far safer choice. You will get better rates, longer repayment periods and transparent terms. Credit unions, like Ascentra, even offer loans, such as “CashNOW” of up to $2,000 without a credit check. These loans are reported to credit bureaus, helping you build credit as you repay.

A credit union offers fair loans, financial coaching and long-term solutions to help you build stability and wealth. When money is tight, it is tempting to use the first lifeline offered, but not all lifelines lead to safety. Many are anchors that pull you deeper into debt. With the right financial partner and a solid plan, you can stay afloat, regain control and steer toward the financial future you deserve.

Related Articles

-

Fixed Rate Mortgage

10 & Done (10 Year Fixed)5.25View Mortgage Loans% -

Vehicle Loans

New & Used Auto as Low as4.99View Vehicle Loans% APR -

Savings

Membership Share Savings Starting at0.05View Savings Accounts% APY -

Credit Cards

No Balance Transfer Fee. 6-Mo. Intro Balance Transfer2.99View Credit Cards% APR