Your Spending Plan

Making Cents of Your Budget

If you’ve ever looked at your bank account and wondered, “Where did all my money go?” you’re not alone.

More than half of Americans live paycheck to paycheck, including a third of households with incomes exceeding $100,000 per year.

The encouraging news is that budgeting doesn’t have to be complicated, and you don’t need a finance degree to get started.

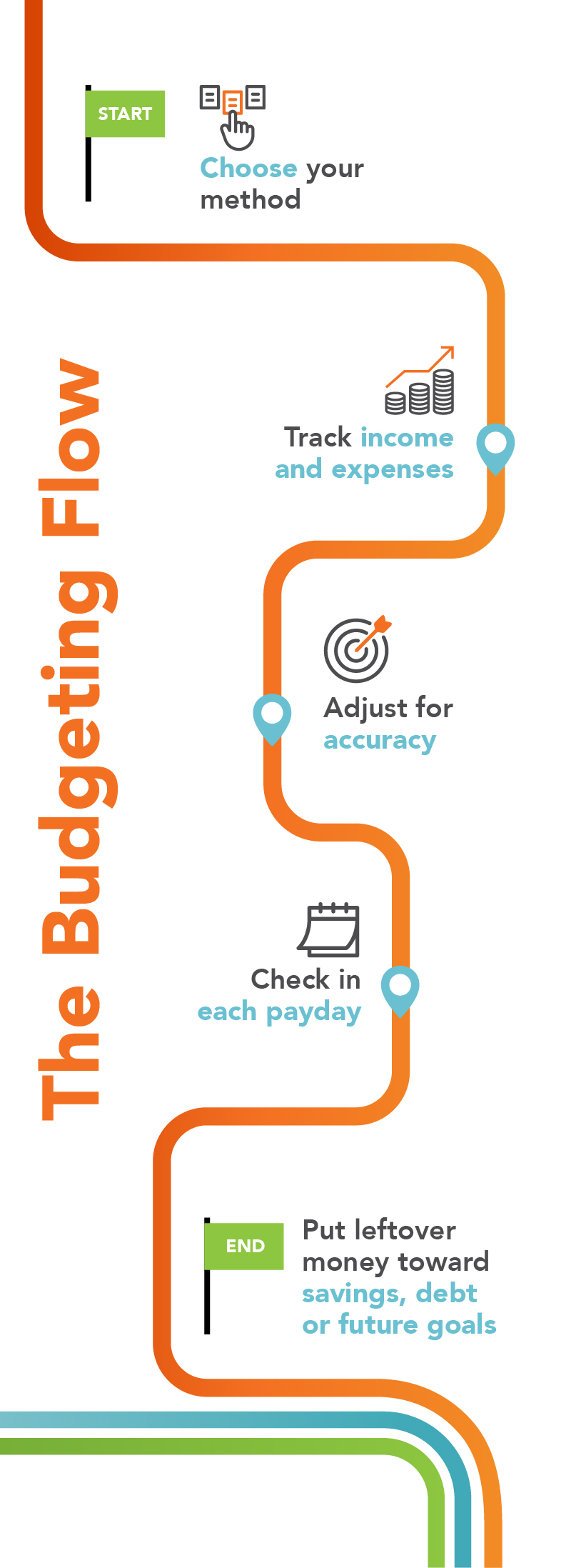

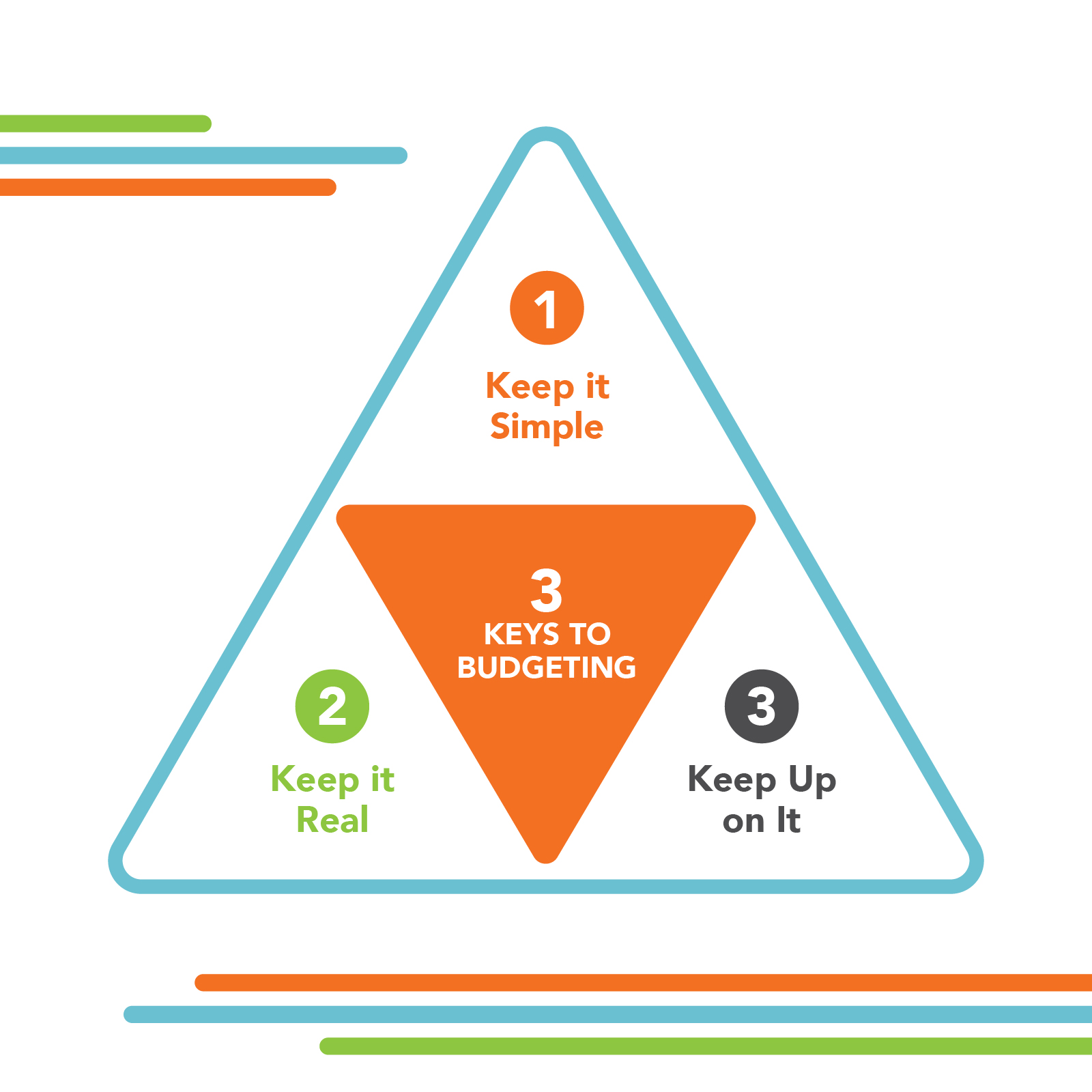

A successful budget follows three simple rules: keep it simple, keep it real and keep up on it. Many people give up on budgeting because they overcomplicate it with elaborate spreadsheets and formulas. In reality, the most effective budgets are often the easiest to use. Being honest about your spending is equally important. If you grab coffee every morning, enjoy fast food lunches or have a hobby that costs money, write it down. Your budget is only for you, so accuracy matters. Finally, consistency is key.

There are several approaches to budgeting, and the best one is the one you’ll actually use.

- For those who prefer technology, budgeting apps make tracking easy by categorizing expenses, sending reminders and displaying helpful charts.

- Members of Ascentra Credit Union can take advantage of the Ascentra app, which offers built-in budgeting tools that break down spending, track trends and even allow for automated bill payments.

- Others may prefer the tried-and-true pen and paper method, simply writing out income and expenses in a notebook.

- Structured plans like the 50/30/20 rule, which divides income into needs, wants and savings, or the zero-based budget, where every dollar has a job, provide useful frameworks.

- The envelope system, where cash is separated into categories, can help curb overspending, while the pay-yourself-first method prioritizes savings before paying bills.

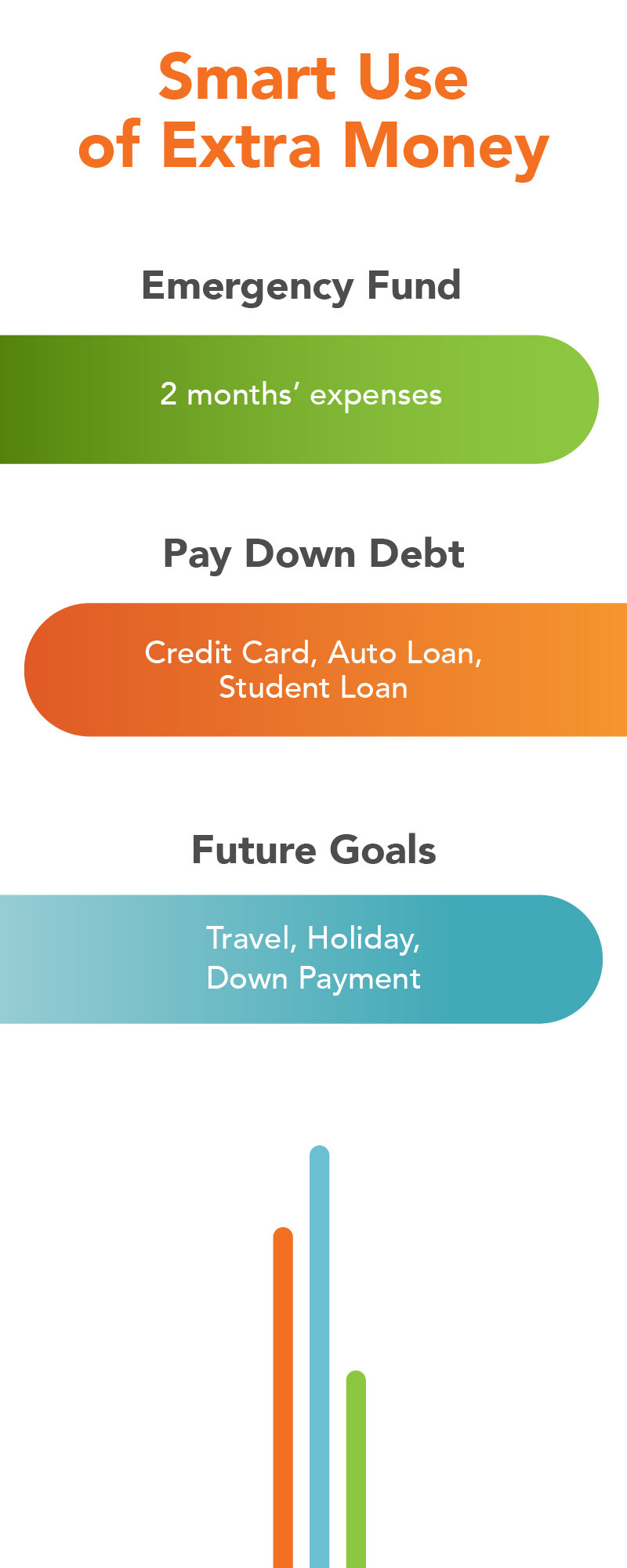

Once your budget is in place, it’s important to make the most of any extra money.

- Building an emergency fund should be the first step, ideally saving at least two months of living expenses to cover job loss, illness or major repairs.

- Paying down debt is another smart move, freeing up more income and reducing the burden of interest.

- Once those priorities are met, setting aside money for opportunities like vacations, holidays or family activities allows you to enjoy the rewards of your efforts.

Budgeting isn’t about restriction. It’s about control and peace of mind.

By starting small, staying consistent and finding the method that works best for you, you can reduce stress, achieve greater financial freedom, and finally feel confident telling your money where to go.

Related Articles

-

Fixed Rate Mortgage

10 & Done (10 Year Fixed)5.25View Mortgage Loans% -

Vehicle Loans

New & Used Auto as Low as4.99View Vehicle Loans% APR -

Savings

Membership Share Savings Starting at0.05View Savings Accounts% APY -

Credit Cards

No Balance Transfer Fee. 6-Mo. Intro Balance Transfer2.99View Credit Cards% APR