Generational Wealth

Creating a Legacy That Lasts

When people think of wealth, they often picture big homes, new cars, or large savings accounts. But real wealth goes beyond what you own today. Generational wealth is about creating financial security and opportunities that benefit your family long after you’re gone, helping future generations focus on growth instead of just getting by.

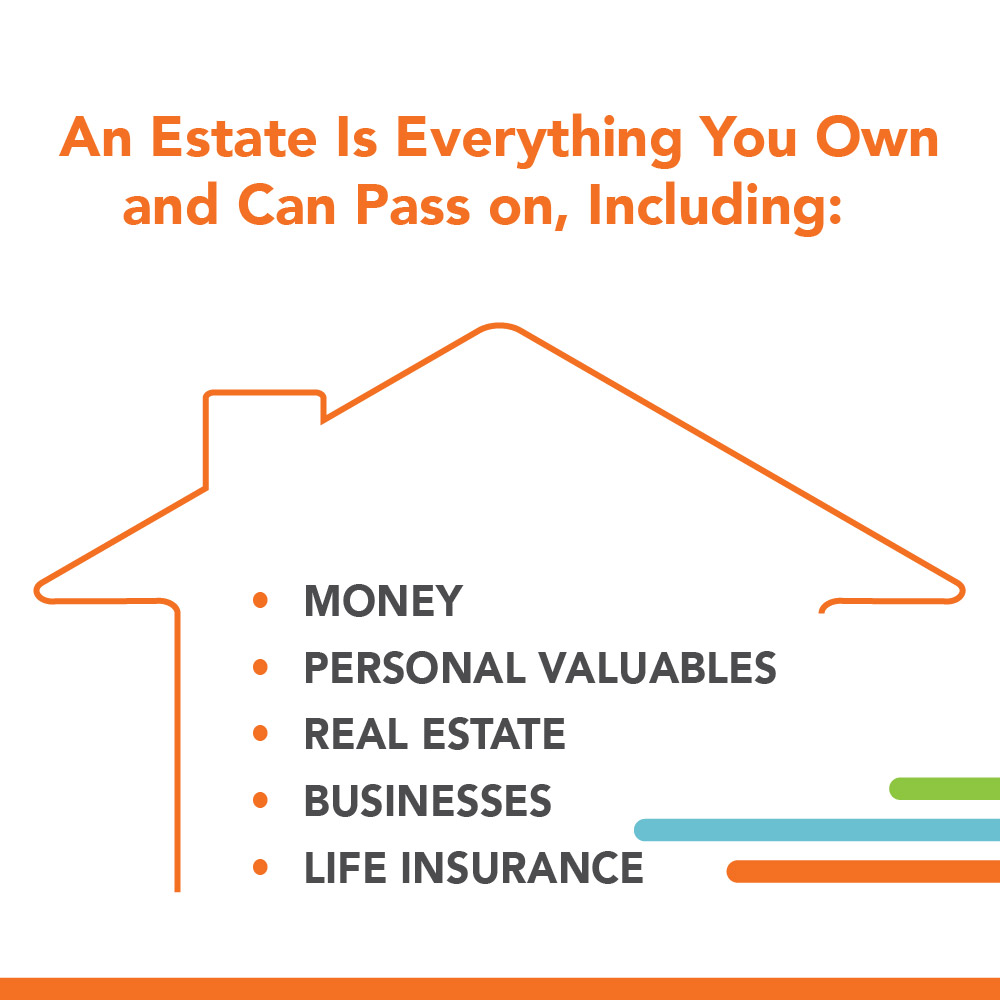

Generational wealth includes the assets you can pass on, such as savings, personal valuables, real estate, businesses, and life insurance benefits. Together, these make up your estate, also known as your net worth. Many factors influence how wealth is built, including family circumstances, financial habits, education, and access to resources.

One of the most effective ways to build wealth is through homeownership. As you pay down your mortgage and property values increase, you build equity, which is the difference between what your home is worth and what you owe. That equity can be borrowed against, used to help start a business, or passed on to future generations. A home can also become an income-producing rental property or a long-term family residence that continues to build value over time.

Because every financial situation is different, working with a financial professional can help you choose investments that align with your goals, timeline, and comfort with risk.

Financial investments also play a key role in growing wealth. Lower-risk savings options like certificates, high-yield savings accounts, and money market accounts help your money grow steadily. Market investments, such as stocks, bonds, mutual funds, and retirement accounts like IRAs and 401(k)s, offer greater long-term growth potential through compound interest, though they also involve more risk.

Protecting what you build is just as important as building it. Reducing debt helps ensure more of your assets go to your loved ones rather than toward outstanding balances. Estate planning tools such as wills, trusts, and beneficiary designations help make sure your wishes are carried out and can reduce delays, costs, and stress for your family. Life insurance can also provide immediate financial support for beneficiaries, helping cover living expenses, education costs, debt, and funeral expenses.

Building generational wealth doesn’t happen by chance, and it doesn’t require perfection or huge incomes to begin.

Building generational wealth starts with small, intentional steps like learning about your options, setting goals, and using available resources to create a plan. By acting today, you are not only strengthening your own financial future, but also creating opportunities for your children, grandchildren, and generations to come. A lasting legacy begins with the choices you make right now.

Learn more about generational wealth by watching our Making Cents Financial Fitness video on Generational Wealth and learn how to get started by scheduling a Financial Coaching session with an Ascentra Financial Expert.

Related Articles

-

Fixed Rate Mortgage

10 & Done (10 Year Fixed)5.25View Mortgage Loans% -

Vehicle Loans

New & Used Auto as Low as4.99View Vehicle Loans% APR -

Savings

Membership Share Savings Starting at0.05View Savings Accounts% APY -

Credit Cards

No Balance Transfer Fee. 6-Mo. Intro Balance Transfer2.99View Credit Cards% APR